President Trump has made tax cuts a top legislative priority, urging Congress to take action on a series of tax cuts and adjustments aimed at boosting economic growth and providing relief for middle-class Americans. Treasury Secretary Scott Bessent has been tasked with spearheading negotiations, working with lawmakers to advance the administration’s tax agenda.

During a press briefing, The White House emphasized that the President tax proposals are designed to put more money back into the pockets of workers and retirees while ensuring businesses have the incentives needed to grow and invest in the United States. His plan includes a mix of tax cuts, targeted loophole closures, and measures aimed at promoting American manufacturing.

As negotiations unfold in Congress, Trump’s administration is focused on securing bipartisan support for key provisions, particularly those aimed at workers and seniors. With Bessent leading the discussions, the White House hopes to build momentum behind these reforms and push for legislative action in the coming months.

The administration’s tax plan includes:

No Tax on Tips

Tipped workers, such as restaurant and hospitality employees, would no longer have to pay federal taxes on their gratuities, allowing them to keep more of their earnings.

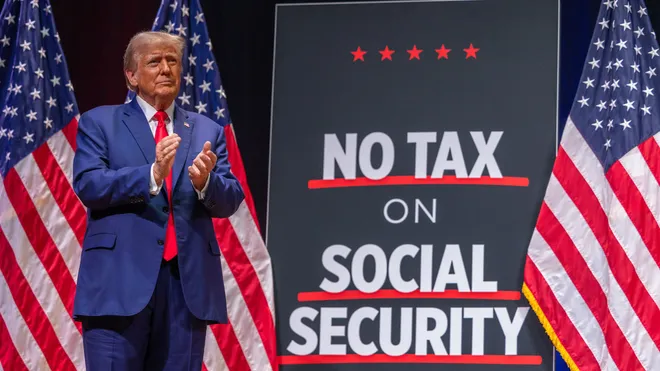

No Tax on Seniors’ Social Security

Trump proposes eliminating federal income tax on Social Security benefits, ensuring retirees receive their full payments without reductions due to taxation.

No Tax on Overtime Pay

Overtime wages would be exempt from federal income tax, meaning workers who put in extra hours would take home more pay.

Renewing the Trump Tax Cuts

The administration is pushing for an extension of the 2017 Trump Tax Cuts, which lowered individual and corporate tax rates. Without congressional action, these cuts are set to expire in 2025.

Adjusting the SALT Cap

The cap on state and local tax (SALT) deductions, currently set at $10,000, would be adjusted to provide greater relief for taxpayers in high-tax states like California, New York and New Jersey.

Eliminating Special Tax Breaks for Billionaire Sports Team Owners

Trump’s plan seeks to eliminate tax loopholes that allow sports team owners to benefit from excessive tax write-offs and depreciation deductions.

Closing the Carried Interest Loophole

Hedge fund managers and private equity executives currently benefit from a tax loophole that allows them to pay lower rates, 20% instead of the ordinary rate of 37%, on their earnings. The administration is proposing to close this loophole and tax these earnings at regular income rates.

Tax Cuts for Made in America Projects

To encourage domestic production, Trump’s plan includes tax cuts for businesses that manufacture products in the United States, strengthening American industry and reducing reliance on foreign imports.