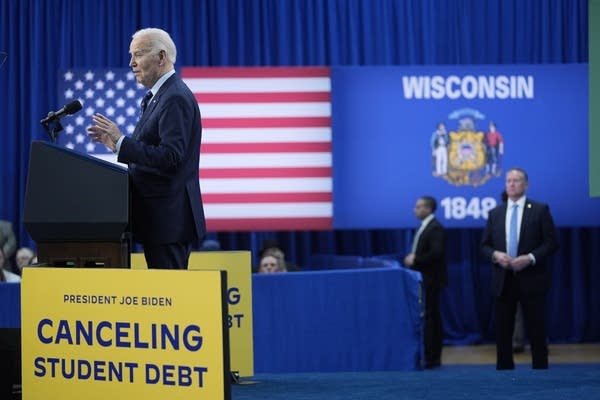

In a recent announcement made on the UW-Madison campus, President Biden unveiled his ambitious plan for student loan forgiveness.

President Biden plan offers debt relief to more than 30 million borrowers by forgiving debt for those who have been in repayment for 20 or more years, eligible for the Public Service Loan Forgiveness, borrowers experiencing hardship, eliminating interest for some borrowers, and canceling student debt for borrowers who enrolled in school programs considered “low value.”

The staggering weight of student loan debt in the United States is undeniable. With over 45 million borrowers collectively owing nearly $1.8 trillion, the issue reaches far beyond individual financial struggles. Many borrowers simply can’t pay back these loans, some can but will wait for bailout, and some borrowers took out loans for degrees that have not yielded them a financial benefit in their careers.

On the surface, Biden’s proposal appears to offer relief to millions burdened by student loan debt. However, when you dig deeper into the effects of student loan forgiveness you can’t ignore the inflationary effects, and the cost burden passed on others.

Biden plans cost roughly 400-600 billion dollars. The cost of this plan will result in more printing of your dollar. After all, the loans must be paid back, and forgiveness will result in taxpayers having to cover the cost by borrowing for the entire cost of Biden’s plan.

One of the most pressing concerns surrounding Biden’s proposal is its inflationary impact. Injecting such a massive sum of money into the economy without addressing underlying structural issues could fuel inflationary pressures, exacerbating existing inflation and further reducing the value of the dollar.

Consider the scenario of someone who receive loan forgiveness: suddenly, individuals find themselves relieved of substantial debt. This newfound financial freedom may prompt increased borrowing and spending for other expenses, leading to heightened demand, particularly in markets with shortages like housing and automobiles. This surge in demand without a corresponding increase in supply can fuel inflationary pressures, further straining the economy. This wealth effect makes you feel richer, although your income and monthly bills are the same as they were before.

Biden plan raises questions of fairness. By forgiving student loan debt, the burden is effectively transferred from borrowers to taxpayers, including those who have paid off their loans, those who did not attend college, and future generations who will inherit the fiscal consequences of today’s decisions.

Perhaps most concerning is the absence of a comprehensive strategy to address the root causes of skyrocketing tuition costs and the financial barriers to higher education. While forgiving existing debt provides immediate relief, it fails to tackle the systemic issues driving the crisis.

While Biden’s student loan forgiveness plan offers temporary relief, its long-term consequences demand scrutiny. Without addressing underlying structural issues with the cost of higher education, the plan risks exacerbating inflation, widening wealth gaps, and burdening future generations with already unsustainable debt.