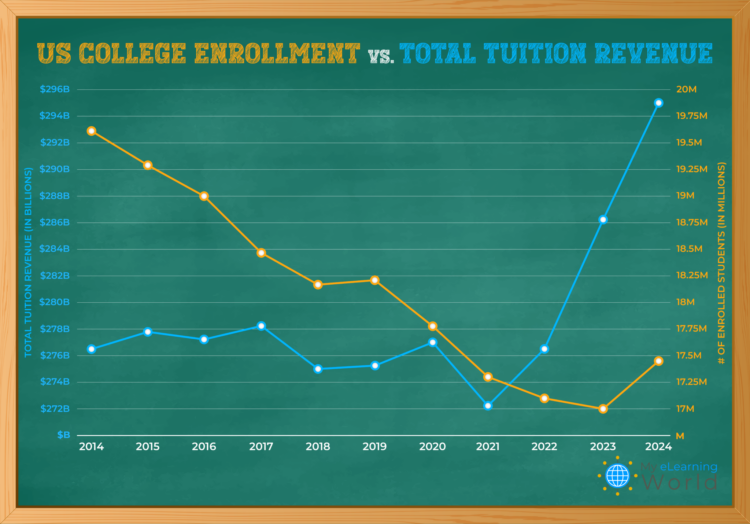

Over the past decade, U.S. college enrollment has been steadily declining, a trend exacerbated by the COVID-19 pandemic. Despite a slight recent increase in 2024, experts predict this downward trend will continue, driven by rising tuition costs and a shrinking population of college-aged individuals. According to the U.S. Bureau of Labor Statistics, the decrease in the college-going rate since 2018 is the steepest on record, with an estimated 2.16 million fewer students expected to enroll in the 2024 school year compared to ten years ago.

Surprisingly, this decline in enrollment has not led to a decrease in tuition revenue. In fact, total tuition revenue has increased by $18.4 billion over the last decade, despite an 11% drop in student numbers. This increase is largely due to rising tuition fees across all types of institutions. Public universities, for instance, have seen in-state tuition rise from $9,950 in 2014 to an estimated $11,260 in 2024. Private universities have experienced similar increases, with average annual tuition now exceeding $41,000.

Community colleges, however, are the exception, with both enrollment and revenue declining. The average tuition at these institutions has only slightly increased, leading to a reduction in total revenue from $22 billion in 2014 to $19.1 billion in 2024.

The rising cost of college education has far outpaced inflation, increasing by over 600% in the past 40 years. This surge has raised concerns about the return on investment (ROI) of a college degree, particularly as student debt continues to climb, with the average borrower now owing nearly $39,000. Total U.S. student loan debt has reached approximately $1.77 trillion.

If college costs had increased only at the rate of inflation over the past 40 years, the average annual expense for tuition, room, and board at a public college would be around $10,493. For private universities, the cost would be approximately $23,740 per year.

Despite these trends, colleges and universities seem to lack incentives to lower tuition fees. The increase in tuition revenue, even amidst declining enrollment, suggests that institutions can continue to charge high fees without losing financial stability. However, this situation may not be sustainable, as more young adults opt out of higher education due to the prohibitive costs. A recent survey indicates that confidence in higher education has dropped significantly, with only 36% of U.S. adults expressing a high level of confidence, down from 57% in 2015.

The growing student debt crisis and declining confidence in the value of a college degree may prompt a reevaluation of the entire system, potentially leading to significant changes in how higher education is funded and accessed in the future.