As people across the country attempt to understand the effects of the ‘Big Beautiful Bill’ that was signed into law by President Donald Trump on July 4th, one aspect of the bill has been overlooked.

The bill, which significantly increased funding for efforts such as immigration enforcement and significantly altered the American tax code, also brought major changes to the US government’s student aid and loan policies for college students.

In addition to creating new student loan repayment programs and expanding access to Pell Grants, the bill will eliminate Grad PLUS loans, a loan program for graduate students with a controversial history. (RELATED: Speaker Vos: UW Budget not Just About Cuts)

Unlike other government student loan programs such as Stafford Loans, Grad PLUS loans do not have a set limit on how much the student can borrow, allowing them to take out loans for the full cost of tuition and other living expenses.

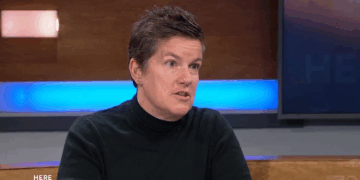

While they have been used by a large number of graduate students, including people pursuing professional degrees such as doctors and lawyers, some people have expressed concerns that the loans are exploitative. Andrew Gillen of the Cato Institute explained how universities use Grad PLUS loans as a blank check to increase tuition prices for all students, regardless of if they are taking out loans or not.

“It’s common for colleges to raise tuition to exploit financial aid programs, but Grad PLUS was arguably their favorite tool. A recent study found that the creation of Grad PLUS “led to significantly higher program prices … sticker prices went up approximately dollar for dollar with increases in federal loans.” That is, for each dollar loaned to a student, colleges increased tuition by basically the same amount.” (RELATED: Amid National Debate Over Foreign Nationals in Higher Ed, UW Reports Employing 500 Foreigners)