The U.S. Supreme Court has unanimously ruled that the Catholic Charities Bureau in Superior, Wisconsin, does not have to pay state unemployment taxes—a significant win for religious liberty advocates.

The 9-0 decision overturns a previous ruling by the Wisconsin Supreme Court’s liberal majority, which held that the organization’s work was primarily charitable and secular, not inherently religious. That court sided with the state’s Department of Workforce Development and its Labor and Industry Review Commission, denying Catholic Charities a religious exemption.

But Justice Sonia Sotomayor, writing for the high court, said the state violated the First Amendment by treating Catholic Charities differently from other religious organizations that are exempt from the tax.

“There may be hard calls to make in policing that rule, but this is not one,” she wrote. “When the government distinguishes among religions based on theological differences in their provision of services, it imposes a denominational preference that must satisfy the highest level of judicial scrutiny.”

RELATED: The Future of Trump-Era Tax Cuts and What Happens If They Expire

Justice Clarence Thomas added that religious institutions are protected by the Constitution’s guarantee of church autonomy, which prevents government interference in their internal affairs, according to WPR.

Catholic Charities, the charitable arm of the Diocese of Superior, operates more than 60 programs helping people with disabilities, seniors, and low-income families. Bishop James Powers praised the ruling.

“We’re grateful the Court unanimously recognized that improving the human condition by serving the poor is part of our religious exercise and has allowed us to continue serving those in need throughout our diocese and beyond,” he said.

Attorney Colten Stanberry from the Becket Fund for Religious Liberty, which represented the diocese, called the decision a win for people of all faiths.

“This is an instance where you see the Supreme Court in a religious liberty case saying, ‘Hey, you don’t get to discriminate against people based on what they believe,’” he said.

Wisconsin argued that Catholic Charities had been paying the unemployment tax for over 50 years and that its services, while inspired by Catholic teachings, were not overtly religious.

RELATED: Inflation Plunges as Trump’s Tariff “Liberation Day” Defies Economic Fears

Secular advocacy groups sharply criticized the ruling. The Freedom From Religion Foundation warned the decision could pave the way for other large religiously affiliated institutions—like hospitals—to seek similar exemptions, potentially leaving hundreds of thousands of workers without unemployment coverage.

“The ruling, even though it’s as applied to the situation, could have really devastating consequences for workers nationwide,” said staff attorney Sammi Lawrence.

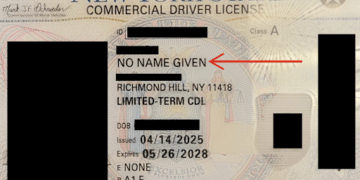

Catholic Charities previously won an exemption in 2015 for one of its subsidiaries but faced a reversal in 2022 by a state appeals court. The Wisconsin Supreme Court upheld that decision, arguing the group did not attempt to proselytize or distribute religious materials.

The U.S. Supreme Court’s latest ruling, however, says none of that matters—the Constitution prohibits governments from treating religious groups differently based on their approach to charity.