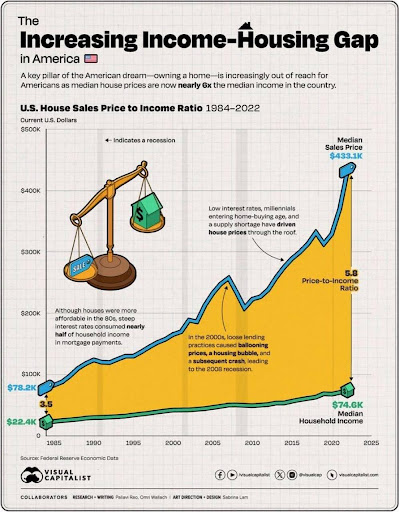

For decades, owning a home was considered a cornerstone of the American dream — a sign of financial stability and a foundation for building wealth. But for younger generations, that dream is increasingly out of reach.

Data from the Federal Reserve shows the U.S. median home price has surged to $433,100, nearly six times the median household income of $74,600. That’s the highest price-to-income ratio in modern history, up from just 3.5 in the mid-1980s.

In 1984, the median home price was just 3.5 times the median household income. Today, it’s nearly 6 times — with the median sales price soaring to $433,100 while incomes lag behind at $74,600. The typical family must now commit a far greater share of its income to housing costs, even before factoring in today’s high interest rates.

This affordability crisis isn’t just about high home prices, it’s compounded by stubbornly high mortgage rates, which have hovered above 6.6% since 2023. For first-time buyers, the combination of inflated home values and elevated borrowing costs can add hundreds — even thousands — of dollars to monthly payments compared to buyers just a few years ago. That makes saving for a down payment harder and qualifying for a loan more difficult.

The generational divide is stark. In 1960, more than half of 30-year-olds were both married and homeowners. Today, that figure has plummeted to less than 15%, reflecting not only economic headwinds but also shifting life milestones. Many young adults delay marriage, have children later, and rent longer, often because buying a home simply isn’t financially feasible. (RELATED: Wisconsin Farmers Remain Bullish About Trump Tariffs Despite Momentary Setbacks)

Older generations often point to the sky-high interest rates of the late 1970s and early 1980s—when mortgage rates topped 15%—as proof they faced tougher conditions. But that narrative leaves out a key fact: homes were far cheaper then. A double-digit interest rate on a $60,000 house is simply not comparable to a 7% rate on a $400,000 house. The real crisis today is the combination of elevated interest rates, stagnant wage growth, and historically high price-to-income ratios that have made homeownership increasingly unattainable for younger Americans.

Meanwhile, those who managed to buy in recent years face a different kind of challenge. Homeowners who purchased at lower interest rates before the Federal Reserve’s aggressive rate hikes now find themselves effectively “locked in” to their current mortgages. Refinancing at today’s higher rates would mean significantly higher monthly payments, leaving many stuck in place even if they want to move. For those who bought at peak prices with higher rates, the reality is worse: they’re carrying heavier debt loads without the option to refinance down.

For Millennials and Gen Z, the barriers to entry are steep. Down payments now require years—sometimes decades—of savings. Student loan debt and rising costs of living eat into disposable income. Meanwhile, limited housing supply and strong demand keep prices high, even in smaller cities and towns. (RELATED: Out-of-State Billionaires Propel Wisconsin Democratic Fundraising Surge)