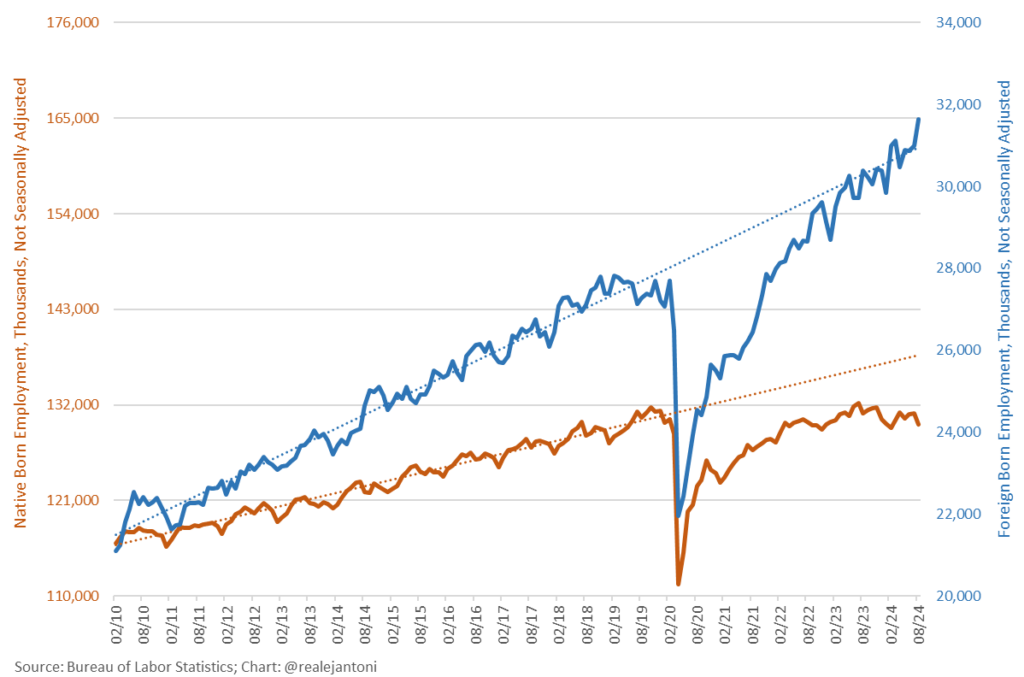

The latest jobs report highlights contrasting trends in the labor market, with foreign-born workers seeing job gains while native-born workers face employment losses. Over the past year, 1.2 million foreign-born workers have secured jobs, whereas 825,000 native-born workers have lost employment. These shifts raise questions about the broader economic landscape and the challenges that many Americans continue to navigate.

Manufacturing Sector Faces Continued Decline

The manufacturing sector has been hit particularly hard. Over the last two months, more than 34,000 manufacturing jobs have been lost, including 7,000 in the past month. Overall, manufacturing employment has declined in three of the last four months, resulting in 37,000 fewer workers in this key sector compared to the previous year. The long-term implications of this decline are of concern, given the sector’s historic role in supporting the U.S. economy.

Job Losses Extend to Other Key Sectors

In addition to manufacturing, other sectors such as transportation and warehousing are also experiencing job losses. These industries, which are vital to the nation’s supply chain, saw a reduction of 9,000 jobs last month. The unemployment rate has increased, with 6.8 million Americans now unemployed, up from 6.3 million a year ago. The labor force participation rate remains below pre-pandemic levels, indicating that some workers are still facing difficulties re-entering the workforce.

Long-Term Unemployment Remains a Challenge

Long-term unemployment continues to be a persistent issue, with the number of Americans unemployed for 27 weeks or more increasing by 97,000 last month. Additionally, over half a million more individuals have taken on part-time work for economic reasons over the past year. Meanwhile, the divide between private sector and government employment has widened, with 502,000 fewer private-sector jobs and 696,000 more government positions compared to the same period last year.

Economic Pressures Mount for American Households

Many Americans are feeling the impact of rising prices, with inflation contributing to a 20.3% increase in costs since 2021. Nearly half of all Americans report financial strain, and two-thirds of households are now living paycheck-to-paycheck. Saving has become more difficult for 65% of Americans, and even retirees are considering re-entering the workforce to cope with the increased cost of living.

Higher Energy Costs Add to Household Expenses

Energy costs have placed additional financial pressure on households, with families spending an average of $4,812 more on energy bills since early 2021. The price of gas currently averages $3.18 per gallon, almost a dollar higher than two years ago. Rising costs have also made homeownership less accessible, with a six-figure salary now required to afford a typical home in nearly half of the U.S.

Striving for a Balanced Economic Recovery

Despite some areas of job growth, the latest data reflect the ongoing challenges faced by many American workers. Economic recovery efforts will need to address these challenges, particularly in sectors like manufacturing and energy that have long been central to the economy. Ensuring a balanced recovery for both foreign-born and native-born workers remains a critical goal as the country navigates these economic shifts.