The State of Wisconsin Investment Board (SWIB) has made history by becoming the first state pension to publicly disclose holdings in spot Bitcoin exchange-traded funds (ETFs). This landmark move was revealed in a recent filing with the U.S. Securities and Exchange Commission (SEC), where SWIB reported over $162 million in digital currency investments.

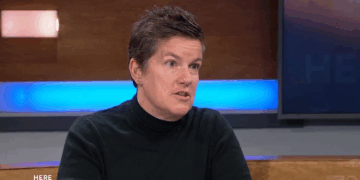

This disclosure underscores the growing acceptance of Bitcoin in traditional investment portfolios. Eric Balchunas, a Senior ETF Analyst at Bloomberg, remarked on the significance of the move, stating, “Wow, a state pension bought $IBIT in the first quarter. Normally, you don’t see big institutions like this in the 13Fs for a year or so (when the ETF gets more liquidity), but as we’ve seen, these are no ordinary launches.” He further predicted, “Good sign, expect more, as institutions tend to move in herds.”

Market researcher and analyst MacroScope emphasized the long-term implications of this move, stating, “This is a small part of a massive public investment fund. But the long-term importance cannot be overstated. Wisconsin is now the second-largest reporting holder of IBIT globally. This will be closely analyzed and widely discussed by other state investment boards. Watch for others to follow in coming quarters.”

The decision by SWIB to invest in Bitcoin ETFs marks a significant step forward in the integration of digital currencies into traditional investment vehicles. It signals a growing confidence in Bitcoin as an asset class and could pave the way for other state pension funds to follow suit. As the landscape of investment continues to evolve, the role of digital currencies in diversified portfolios is likely to become increasingly prominent.